VITA TAX SERVICE

Tri-County Community Action Partnership Offers Professional Tax Preparation at NO Charge!

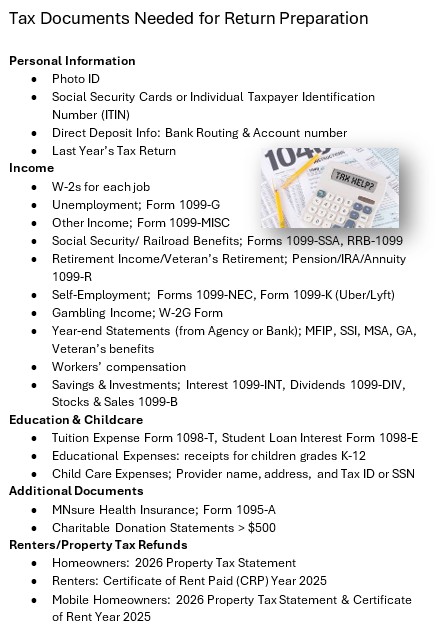

You Qualify for Tax Prep If:

Household income is under $35,000 for singles and $67,000 for families.

For more information and to schedule an appointment contact: 888-441-7215

Little Falls

Mondays and Thursdays

Brainerd

Tuesdays

Long Prairie

Wednesdays

Staples

Mon 03/02 & 03/16

Spanish Translation available at each location.

You may qualify for free electronic filing

The following software may allow you to prepare and file your income tax returns for free. Eligibility varies by product and depends on your income and other factors.

Use only one software to file both your federal and state income tax returns. Once a return is submitted you are no longer eligible to e-File using a different software provider.

(Please note – Cash App returns must be started on a phone, and on-screen directions will show you how to transition the return to a desktop if you prefer.)

For information on the status of your tax return...

You can call or check online with the IRS and MN Department of Revenue.

To use Where’s My Refund?, Taxpayers must enter their Social Security number or Individual Taxpayer Identification number, filing status and the exact whole dollar amount of their expected refund from the original tax return for the year they’re checking.

To see your IRS-Federal refund status information, Taxpayers must enter:

• Social Security number or Individual Taxpayer Identification number

• Filing status

• The exact whole dollar amount of the expected refund from the original tax return for the year

📞 Call Internal Revenue Service: 800-829-1954

To see your MN-State refund status information, Taxpayers must enter:

• Social Security number or Individual Taxpayer Identification number

• Date of Birth

• Filing status

• The exact whole dollar amount of the expected refund from the original tax return for the year. (Include any portion applied to the next year’s estimated tax.)

📞 Call MN Dept. of Revenue: 800-652-9094